Unleash the potential of Bitcoin: Colossus x Babylon transform institutional BTC staking

Bitcoin Scenario

Before light there was darkness. Before Web3.0 there was Bitcoin. Our beloved crypto asset, has now reached its all time high, sitting nearly at $100,000 for each BTC and with a Market Cap of more than 1.8 Trillion dollars is undoubtedly an important asset for the global economy.

A lot of road has been made since the first block was mined (2009), and the Web3.0 landscape changed as well, sometimes for good, sometimes for bad. We have seen the rise and downfall of the NFTs, Bull runs, the constant fluctuation of the markets and how the media portrayed all of this “tech stuff” as “a scam” or, more rarely, “an opportunity”.

Bitcoin has always been the cherry on top of the cake, or way better, the entire bakery: whether you support it or not, whether the media despise it or prays it, Bitcoin is certainly a symbol. It comes natural that such an important asset still growing to this day and probably for years to come, would be under the eye of institutions. Country’s entities, big asset managers, banks… Everyone in a way or another started their journey through Bitcoin.

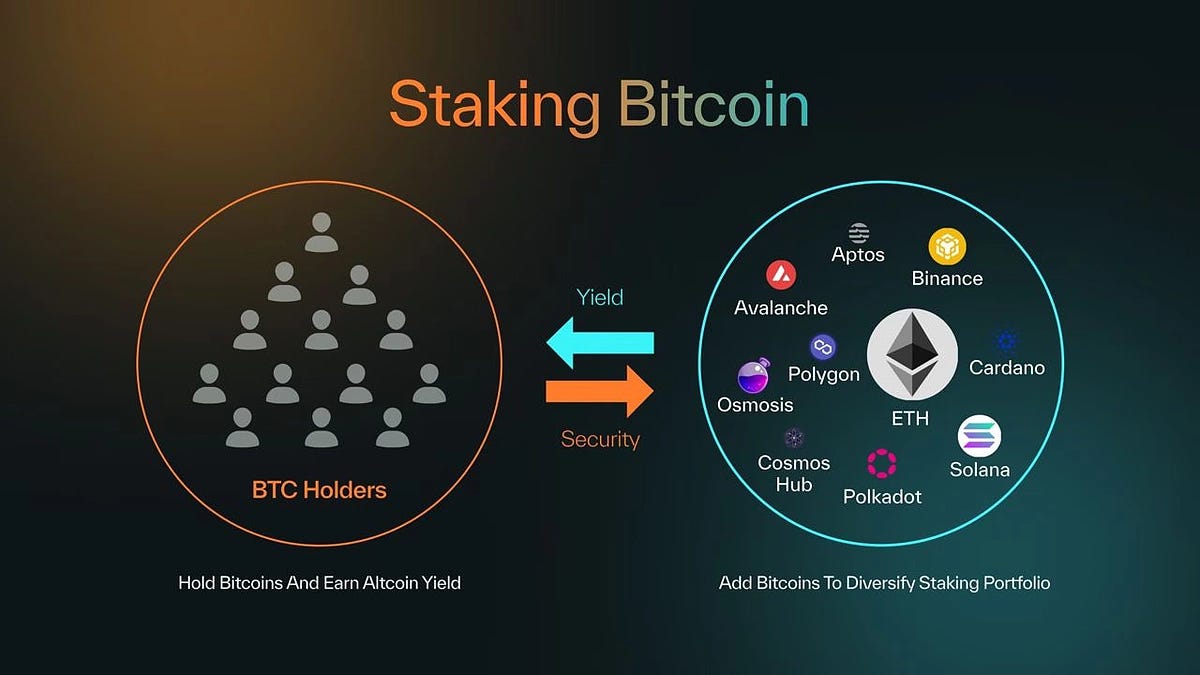

But as much as all the world (especially institutions ) love this asset, things have not been perfect. Bitcoin has been, similar to gold, a reserve of value for most investors, with no other visible utilities. While other chains began to emerge, other consensus mechanisms started to arise: Proof of Stake, Delegated Proof of Stake, Proof of Authority, ecc. Also more complex blockchain came along, with programmable environments, built-in applications, smart contracts. This flexibility and the earning potential derived from staking were missing on Bitcoin. Institutions who held Bitcoin, couldn't earn a return or a yield, on their asset.

They could only wait and hope for the next bull run for a positive fluctuation, or manage their asset by doing some trading and hedging, thus holding a valuable, but “locked” asset. Further immobilization came in with regulation: most companies who have to be regulated by law, need to hold their digital asset in a custody environment, thus strongly limiting the freedom of movement of their asset and the potential for earnings. Despite all of this, the value of Bitcoin was never doubted and in 2024 the SEC approved ETFs for Bitcoin, a fundamental change of direction for asset managers and investors all over the world.

Then the question raised: could Bitcoin have been improved from its state?

Babylon Protocol: Making Staking Possible - Revolutionizing BTC

Imagine Bitcoin as a powerful but traditionally passive asset - it sits in wallets, can be traded, but lacks functionalities and utilities, limiting its earning potential. Babylon is changing that paradigm by creating a revolutionary way for Bitcoin holders to participate in proof-of-stake (PoS) blockchain security without compromising their assets' fundamental nature.

Here's how Babylon achieves this innovative approach:

Babylon introduces a groundbreaking cryptographic approach that allows Bitcoin holders to stake their coins directly on the Bitcoin network without utilising bridges. Using an extract one-time signature (EOTS) system, the protocol creates a unique security mechanism where potential malicious attacks can be converted into burned Bitcoin UTXOs. The key innovations are:

Direct staking within the Bitcoin network

Cryptographic safeguards that keep assets secure

Ability to quickly unbond staked bitcoins

Native control maintained by the asset owner

By locking bitcoins with time-locks and sophisticated synchronization protocols, Babylon enables Bitcoin to participate in proof-of-stake network security while maintaining the asset's fundamental security principles. Stakers can only lose funds if they deliberately attempt to attack the participating blockchain networks.

Babylon employs sophisticated timestamping protocols that create tight synchronization between Bitcoin and proof-of-stake chains. This enables rapid, secure unbonding of staked bitcoins - meaning users can exit their staking positions quickly if needed.

What truly distinguishes Babylon is its "Native Integration" approach. By leveraging Bitcoin's inherent properties, the protocol offers:

Direct, secure bitcoin locking on the native Bitcoin network

Flexible staking across multiple proof-of-stake chains

Scalable "restaking" opportunities

Enhanced security for decentralized applications

A modular protocol adaptable to various blockchain ecosystems

In essence, Babylon transforms Bitcoin from a purely value reserve or transactional asset into an active participant in blockchain security, all while maintaining the fundamental principles of decentralization and security Bitcoin represents.

But still, a very important piece is missing from the equation: Most of these bitcoins are held in custody environments, thus being isolated and cannot be put at stake.

Colossus Institutional Hub: Unlocking Babylon true potential

Colossus, already a Finality Provider on Babylon Protocol, by leveraging DFNS custody solution and its unique features has been able to integrate Babylon on their Institutional Hub, becoming the first finality provider to enable Bitcoin Staking directly from Custody, thus unlocking a market of more than 1,000,000,000$ USD for institutions who are investing in the future of finance.

Everything is set for the next cap, (Cap 3) of the Phase 1 of Babylon happening on December 10th. This phase will feature a duration-based cap with a limit of 1,000 Bitcoin blocks, which translates to approximately one week of participation.

To better understand the success of Babylon, during Phase 1 Cap 2 Babylon, The cap was lifted for about 10 Bitcoin blocks over the course of one hour and 23 minutes, They have been able to pull in about $1.5 billion worth of bitcoin after opening to additional deposits.

In order to understand the potential rewards, In the initial phase of Babylon's Bitcoin Staking protocol, direct staking rewards are unavailable due to the lack of active Proof-of-Stake (PoS) chains. Instead, a points system tracks participant contributions, For the first 300 BTC blocks of this cap, the number of points per BTC block will be set to 100,000.

for the remaining 700 BTC blocks of this cap, and all the BTC blocks afterwards until further notice, the number of points per BTC block will be set to 21,000.

The points per BTC block will be allocated proportionally among all active stakes (from all caps) within that block.

Thanks to the partnership with DFNS and months of development, Colossus has made this huge step forward for the future of enterprise staking. Institutions can now safely stake their Bitcoin without renouncing to the safety of a custody environment.