Shapella: What's Next?

Examining the aftermath of the ETH upgrade, the surge in open interest for futures contracts, and the influence of macroeconomic pressures and the banking crisis on the evolving crypto market.

Thursday and Friday saw a surge in the crypto market following the much-awaited Shapella upgrade's completion on Wednesday night.

Ethereum (ETH) saw a 13% increase in the last 48h and is now trading above $2,100.

Bitcoin (BTC) maintained its stability, trading at around $30,700.

Ethereum Upgrade: Unlocking Staked Ether

The Shapella upgrade unlocked 18 million Ether staked on the blockchain for gradual withdrawal. Analysts had predicted this might trigger a sell-off, but with minimal actual demand to withdraw—significantly below the protocol's maximum limit—the price remained stable.

Analysts: Shapella Less Consequential Than Initially Thought

Ether's rally began hours after the upgrade's completion, around 3 am ET, indicating that Shapella might not be the primary factor behind the surge.

Noelle Acheson, author of Crypto is Macro Now and former head of market insights at Genesis, remarked:

"Although this seems like a belated Shapella response, it's not, at least not directly. A similar BTC jump suggests the ETH move is more of a liquidity and relief play."

Joe Ziolkowski, CEO and co-founder of digital asset insurer Relm Insurance noted:

"Ethereum soared when many were bracing for a massive sell-xoff. As the upgrade began, however, the anticipated panic selling didn't occur, suggesting that the unlocks might not be as dramatic as many had predicted. Although it's still early in the process, the momentum across the ecosystem paints a very optimistic picture for ETH and various liquid-staking protocols."

Increased Market Activity: Ethereum Open Interest Hits 1-Year High

As staking withdrawals were activated this week, Ethereum derivatives markets experienced a surge, with open interest setting new yearly records across multiple exchanges. Data provided by Coinglass:

On Friday morning, there was over $7.6 billion in ETH open interest.

Binance recorded over $3 billion of that OI, just short of the August peak following the Terra debacle.

OKX open interest reached $1.39 billion, the highest in almost 18 months.

Bybit registered a 16-month high with $1.24 billion.

The all-time high for ETH open interest was in November 2021, during the peak of the last bull run, at $11.2 billion.

Market Influencers: Macroeconomic Pressures, Banking Crisis, and Renewed Interest

As for the coming days, analysts foresee macroeconomic pressures and the ongoing fallout from the banking crisis continuing to influence the market. On Thursday, the S&P 500 and Nasdaq Composite indexes experienced pre-market trading gains of 0.4% and 0.6%, respectively.

The collapse of Silicon Valley Bank and Signature last month may have contributed to renewed interest in major cryptocurrencies. Sylvia To, research lead at crypto exchange Bullish, told Blockworks, "Liquidity is also thin in the market, so this has helped exacerbate price action, meaning it doesn't take much to move the market. While there's no definitive way to know who the buy walls were from, it seems there's new interest in the market."

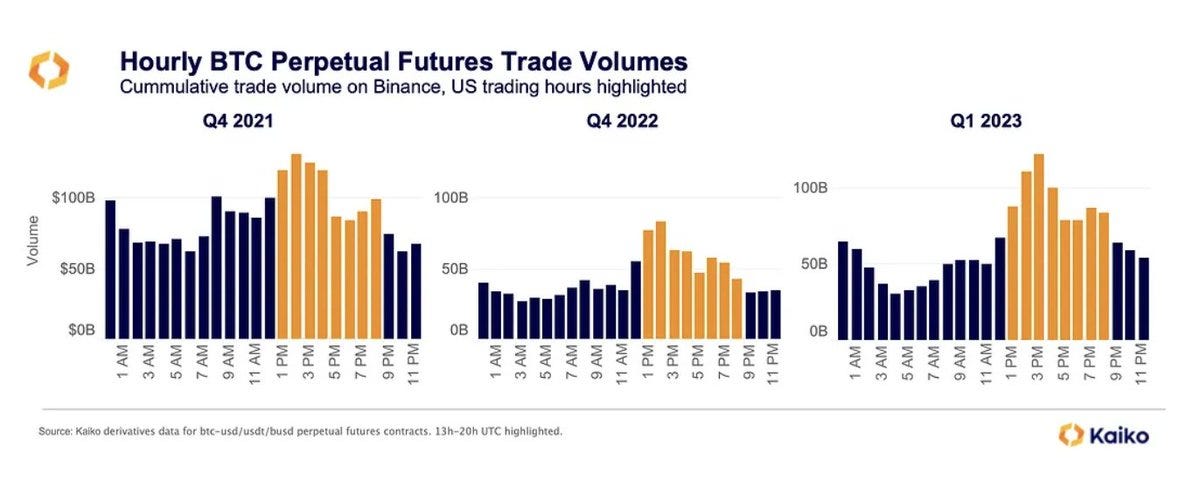

Kaiko's Notices a Shift in Futures-to-Spot Ratios

Kaiko, a crypto data provider, advises traders to monitor the perpetual futures spot ratio. Perpetual futures open interest peaked at nearly $5 billion earlier this month before dropping.

In a recent report, Kaiko analysts observed that ETH markets had been predominantly spot-driven over the past month, as indicated by the perpetual futures-to-spot ratio, which reached its lowest level since the Merge. This is a noteworthy shift, especially considering the ratio had nearly doubled pre-Merge levels at the year's beginning amid a broad crypto rally. Moreover, the ratio has consistently declined since late February as the banking crisis continues to dominate market movements.