An Overview of FTX's Second Presentation for Stakeholders

According to the lawyers, $694 million out of $2.2 billion in assets have been identified in the wallets of accounts associated with FTX.com.

The Situation at FTX

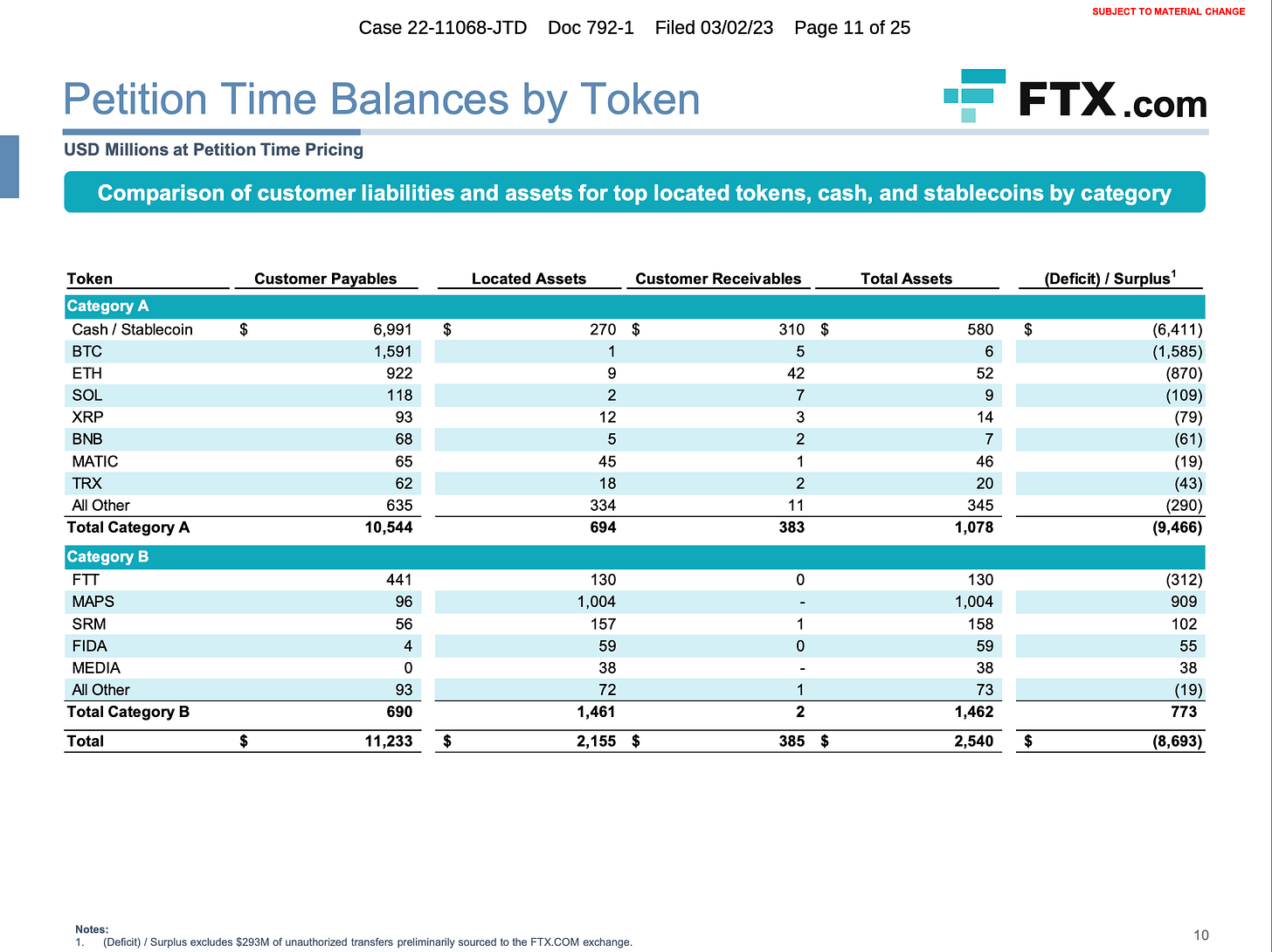

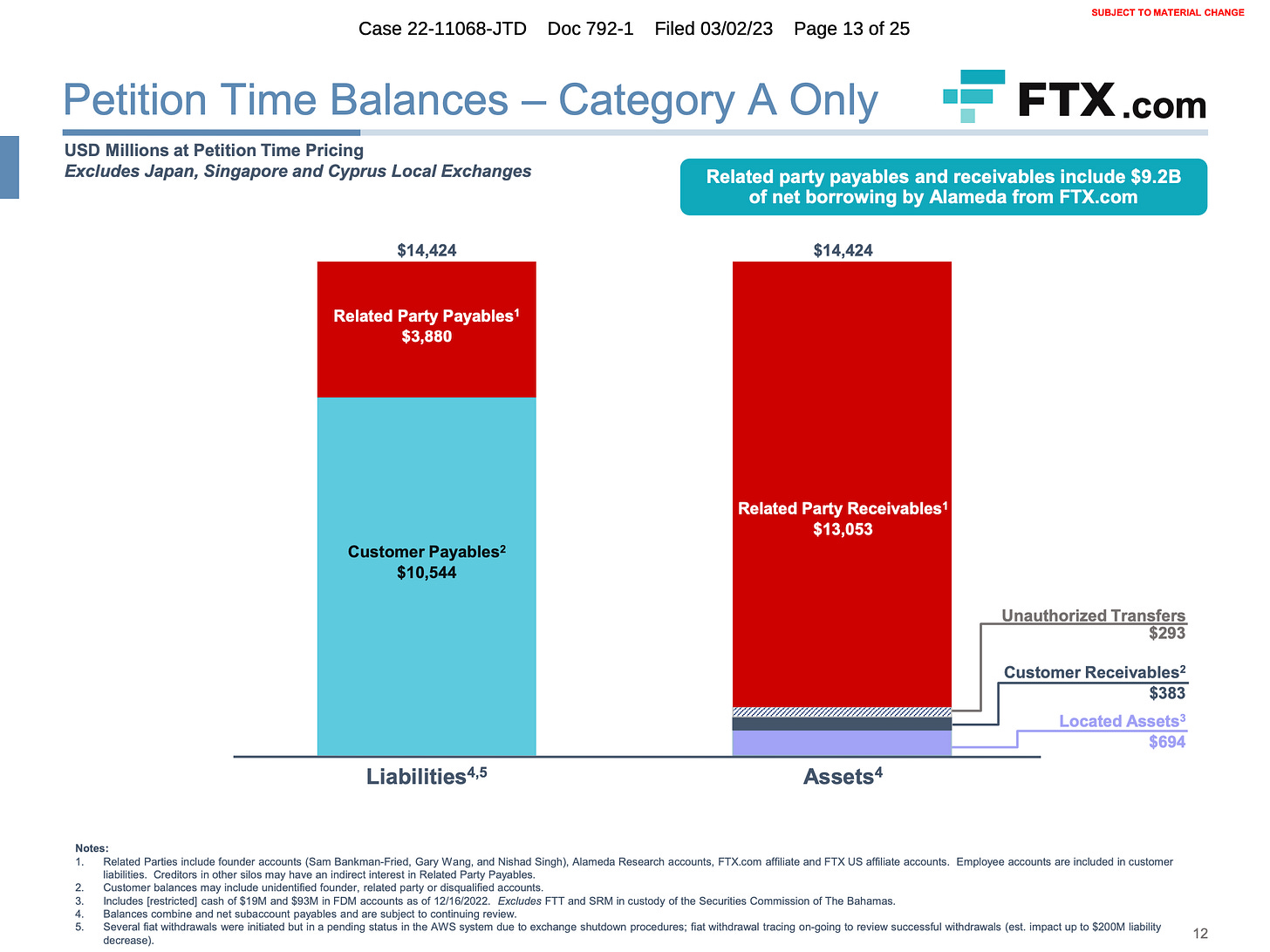

The bankruptcy hearing report published on Thursday, March 2, suggests the company struggles to meet its financial obligations, including paying back lenders and creditors. Based on current spot prices, the wallets of FTX.com accounts hold $2.2 billion in assets. Still, only $694 million of these assets are classified as the most liquid "Category A Assets", which include fiat, stablecoins, bitcoin or ether.

Other assets held by FTX.com accounts include $385 million in customer receivables and significant claims against FTX's sister company Alameda Research and related parties. The presentation also reveals that Alameda has borrowed a net total of $9.3 billion from FTX.com wallets and accounts.

The FTX.US exchange also has a shortfall in assets, with $191 million in accounts associated with the exchange, $28 million in customer receivables and $155 million in related party receivables. Furthermore, FTX.US owes a net $107 million to Alameda Research.

Highly Interconnected Assets at FTX

John J. Ray III, the CEO and chief restructuring officer of the FTX Debtors, states in a press release that the exchanges' assets are highly commingled, and their records are incomplete or absent, making this information preliminary and subject to change.

According to the presentation, FTX has identified $7 billion in customer payables in cash and stablecoins, offset by $580 million in identified assets as of its petition date.

FTX has a deficit for every token classified as a Category A asset, including BTC, ETH, SOL, XRP, BNB, MATIC, TRX, and others.

However, FTX considers Category B tokens such as MAPS, serum, and fida to have surpluses. Unfortunately, these token holdings' value cannot offset Category A liabilities.

The Next Bankruptcy Hearing, Deadlines and Objections

The next bankruptcy hearing is scheduled for March 8, 2023, at 1:00 PM EST at the US Bankruptcy Court in Wilmington, Delaware. The hearing will occur in Courtroom #5 on the 5th floor of the courthouse.

Objections to the bankruptcy proceedings are due by March 7, 2023. Therefore, interested parties need to submit their objections before this deadline to have their concerns heard by the court.

For those unable to attend the hearing in person, a live stream will be available via YouTube. This live stream is being provided by the United States Bankruptcy Court - District of Delaware and can be accessed through their website.

Conclusion

In conclusion, FTX's massive shortfall in assets is a cause for concern among its stakeholders and users. However, it remains to be seen how the company will navigate this challenging situation and its impact on the broader cryptocurrency market.

Nevertheless, it highlights the importance of transparency and accountability in the crypto industry while emphasizing caution when investing in such platforms, as risks are always involved.

As these developments unfold, we will continue monitoring them closely in our blog post, so stay tuned for more updates!